Where will your property tax dollars go in 2017?

Property owners all pay taxes, but where do all of those tax dollars go?

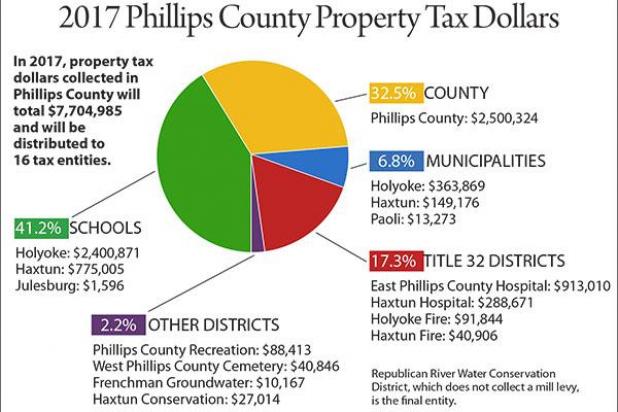

There are 16 tax entities in Phillips County. In total, all the tax entities in Phillips County will collect $7,704,985 in 2017.

Every year in December, most of the taxing entities in the county adopt a mill levy (schools are in June). The mill levy is applied to the assessed value of that entity and determines how many tax dollars they will receive in the upcoming budget year.

The assessed value of the entire county is certified by Doug Kamery, Phillips County assessor.

For 2016, the assessed value of Phillips County was $88,413,157. The mill levies of each tax district are applied to their 2016 value, and taxes are collected in 2017. Some entities get to collect taxes on that entire assessed value, but most collect only on the portion of the county where they provide services.

Of the total 2017 tax dollars, 41.2 percent or $3,177,472 will go to school districts. Holyoke School District will get $2,400,871 in Phillips County tax dollars (also extends into Sedgwick and Yuma counties for additional tax dollars), Haxtun School District $775,005 in Phillips County tax dollars (also extends into Sedgwick, Logan and Yuma counties for additional tax dollars) and Julesburg School District $1,596.

The county is the next biggest tax collector. They will collect $2,500,324 or 32.5 percent of all tax dollars. They divide their total dollars into four categories. About 76 percent ($1,896,463) of that will be used for general fund expenditures. The road and bridge department receives 15 percent ($373,987), but $53,000 of that share is given to the three municipalities for their roads. Human services receives 5.6 percent ($141,461), and the Capital Expenditure Fund gets 3.4 percent ($88,413).

The municipalities collect $526,318 in taxes or 6.8 percent of all tax dollars. Holyoke will receive $363,869, Haxtun $149,176 and Paoli $13,273.

There are four Title 32 districts in the county. Two of them are hospital districts, and two are fire districts. The Title 32 districts collect a total of $1,334,431 or 17.3 percent of all county tax dollars.

East Phillips County Hospital District will collect $913,010, Haxtun Hospital District $288,671, Holyoke Fire District $91,844 in Phillips County tax dollars (also extends into Sedgwick County for additional tax dollars) and Haxtun Fire District $40,906 in Phillips County tax dollars (also extends into Logan, Sedgwick and Yuma counties for additional tax dollars).

There are five other local districts in the county. They collectively garner $166,440 total tax dollars or 2.2 percent of all county tax dollars.

Phillips County Recreation District will collect $88,413 (they primarily support the TV translator system), West Phillips County Cemetery District will collect $40,846, Frenchman Groundwater District will collect $10,167 and also impose a fee of $0.15 per acre foot on wells in the district (this district extends into Logan County), and Haxtun Conservation District will collect $27,014.

The fifth entity, Republican River Water Conservation District, does not collect a mill levy but does impose a fee of $14.50 per acre for all irrigated acres in the county. (They collect about $972,800.)

The taxing districts usually have a number of other funding sources for regular operation.

The school districts receive a direct allocation per student from the state. The municipalities provide utilities (water, sewer, electricity, trash collection) and collect fees for those operations. The hospitals generate fees for patient services and Medicare/Medicaid coverage. County road and bridge department receives 68.7 percent of their operational moneys from the highway users tax fund. The county human services department receives approximately 80 percent of their money from the state and federal government.

Additionally, grants sometimes supplement needs for small and large projects in any or all of these tax entities.